No-medical-exam life insurance policies are a good fit for people who want to skip the medical test and get coverage quickly, or for people who wouldn’t be approved for traditional life insurance due to health reasons.

We analyzed the best life insurance companies on the market based on their underwriting rules, price, policy options, customer satisfaction, and financial strength, to identify the top no-exam insurers for you. Depending on your needs and personal circumstances, these companies will approve you without having to take the medical exam and offer you the best price.

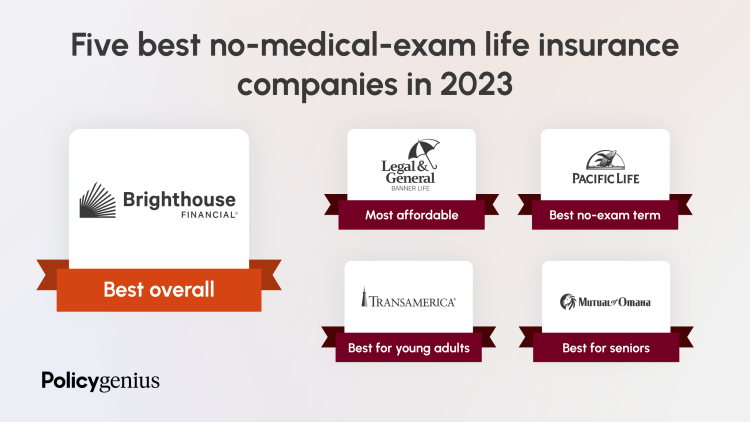

Comparing the best no-medical-exam life insurance companies

See all of our picks for the best life insurance companies

Best overall no-exam life insurance: Brighthouse Financial

Brighthouse Financial offers an instant decision application process that can help you get term life insurance coverage for up to $3 million without having to take a medical exam.

If you have a minor health condition like anxiety, high blood pressure, ADHD, or even sleep apnea, you’re more likely to get a better rate with Brighthouse Financial than with other insurers.

Cheapest no-exam life insurance: Legal & General America

Legal & General America, which also does business as Banner Life and William Penn, offers cheaper policy options than some of its competitors regardless of your health profile.

You can apply for coverage between $100,000 and $2 million without the medical exam — you just have to complete a medical interview over the phone. Legal & General America will then review your application and determine if a medical exam is needed.

Best no-exam term life insurance: Pacific Life

Pacific Life offers some of the most flexible rules for people age 18 to 70 applying for term life insurance, which is the most affordable and popular type of life insurance for most people.

If you’re under the age of 60 and don’t have significant health conditions or risk factors, you’ll complete a health interview to determine if you can get accelerated approval without a medical exam.

If you’re between age 60 and 70 or you have additional medical conditions, Pacific Life will likely request an attending physician statement (APS) to evaluate your health first and determine if you can get approved without an exam.

Best no-exam life insurance for seniors: Mutual of Omaha

Mutual of Omaha offers multiple no-exam policies for seniors. Its options include a term life insurance policy with coverage up to $300,000 for people age 50 and below, up to $250,000 for people age 60 and below, and up to $150,000 for people age 70 and below.

Mutual of Omaha also offers no-exam options with smaller coverage amounts — up to $40,000 — to cover final expenses, like a funeral or medical bills, for people who might not be eligible for traditional coverage due to health issues. This product is available for individuals up to age 85.

Best no-medical-exam life insurance for young adults: Transamerica

Transamerica offers no-exam policies for adults as young as 18 years old and a simple application process — including a health questionnaire that can be filled out online or over the phone.

Transamerica has flexible financial justification guidelines for graduates and undergraduates applying to protect their future income, with coverage amounts of up to $500,000. The company also offers smaller coverage amounts — up to $50,000 — for young adults seeking coverage options to pay for final expenses in a worst-case scenario.

What is no-exam life insurance?

When you apply for life insurance, you usually have to take an in-person medical exam that is similar to an annual physical.

The exam lasts between 20 and 30 minutes and consists of two parts.

First, you have to answer a series of questions about your health, lifestyle, and social habits, including any current prescriptions.

Then, an examiner measures your height and weight, checks your blood pressure, and collects blood and urine samples.

No-exam policies let you skip the medical examination and instead complete a health interview online or over the phone to determine if you qualify for coverage.

Can you buy life insurance if you’re overweight?

Types of no-exam policies

There are three main types of life insurance policies that don’t require you to take a medical exam: traditional term life and two different types of permanent life insurance aimed at covering end-of-life expenses, like a funeral or medical bills: simplified issue and guaranteed issue life insurance.

1. Term life insurance

Term life insurance is usually the best option for most people who want to protect their loved ones from financial hardship if they die. It’s affordable, easy to maintain and understand, and only lasts for a set period of time.

It can take up to six weeks to get approved for term life if you have to take a medical exam. But with some no-exam term options, like instant issue or accelerated underwriting life insurance, your application can get approved in a matter of days — or in some cases even during the initial phone interview. And the good news is that no-exam term life policies are as affordable as comparable policies where you have to go through the full application process.

Just keep in mind that, depending on your age and health profile, some insurers might still ask you to take the medical exam even if you initially qualified for a no-exam term policy.

2. Simplified issue life insurance

Simplified issue life insurance doesn’t expire and usually offers a small payout — up to $40,000 — to cover final expenses. It’s commonly reserved for people who are 45 years old and above, and who may not qualify for traditional life insurance due to health reasons.

While you don’t have to take a medical exam, you do need to answer a few questions related to your health. Certain conditions, like some types of cancer or a terminal illness, might disqualify you for this type of policy. Getting approved can take up to two weeks.

3. Guaranteed issue life insurance

Guaranteed issue life insurance is another type of policy that offers a small coverage amount — usually up to $25,000 — to cover final expenses. You don’t have to take a medical exam or answer any questions about your health as part of the application — approval is guaranteed for most people age 45 to 85, depending on the insurer — and you can get approved in up to three days.

If you have a pre-existing condition that would disqualify you for nearly any other kind of policy, guaranteed issue can be your best bet.

If you’re not sure which of these options is right for you, a Policygenius agent can help. At Policygenius, our agents work for you, not the insurance company, and can walk you through the entire life insurance buying process while offering transparent, unbiased advice.

Comparing no-exam policies

How much does no-medical-exam life insurance cost?

A 30-year-old female could pay $22.99 per month for a no-medical-exam term life insurance policy with a 20-year term and a $500,000 coverage amount. A 30-year-old male could pay $29.33 per month for the same coverage.

Simplified issue and guaranteed issue options are usually significantly more expensive. How much you pay for life insurance will depend on which type of policy you’re applying for, as well as your age, gender, and health.

Average no-exam term life insurance rates

Methodology: Average monthly rates are calculated for male and female non-smokers in a Preferred health classification obtaining a 20-year $500,000 term life insurance policy. Life insurance averages are based on a composite of no-medical-exam policies offered through Policygenius from Brighthouse Financial, Legal & General America, Transamerica, and Pacific Life. Rates may vary by insurer, term, coverage amount, health class, and state. Not all policies available in all states. Issuance of a term life insurance policy without a medical exam is subject to product availability and your eligibility, and may depend upon your truthful answers to a health questionnaire. Rate illustration valid as of 01/01/2024.

Average simplified issue life insurance rates

Methodology: Sample monthly rates are calculated for males and females obtaining a $25,000 guaranteed issue life insurance policy. Life insurance rates are based on guaranteed issue life insurance policies offered through Policygenius from Corebridge Financial. Rates may vary by insurer, term, coverage amount, health class, and state. Not all policies are available in all states. Rate illustration valid as of 01/01/2024.

Average guaranteed issue life insurance rates

Methodology: Sample monthly rates are calculated for males and females obtaining a $25,000 guaranteed issue life insurance policy. Life insurance rates are based on guaranteed issue life insurance policies offered through Policygenius from Corebridge Financial. Rates may vary by insurer, term, coverage amount, health class, and state. Not all policies are available in all states. Rate illustration valid as of 01/01/2024.

How to buy a no-exam policy

In my experience working as a licensed agent, most people chose the no-exam route whenever available, since the standard application can take up to six weeks on average. Getting approved for a no-medical-exam policy is the fastest way to get coverage, and often also the cheapest.

What happens if your application is declined?

If you get turned down at first, don’t fret.

Getting declined for a no-exam policy doesn’t necessarily mean that you won’t be eligible for life insurance or that your rate will be more expensive. It simply means that the insurer needs more information to assess your risk and might ask you to take an in-person medical exam.

The insurer will give you a reason for their decision to decline your application, and based on the information provided, your agent can help you decide how to move forward in getting coverage.

What options do you have if you’re not eligible for no-exam life insurance?

If a no-exam policy is not an option for you, you can apply for a fully underwritten policy. This means you’ll have to go through the full application process, which includes an in-person medical exam.

A fully underwritten option will also allow you to apply for higher coverage amounts if you need them — most no-exam options cap coverage at $1 million to $3 million.

And depending on your health profile, you may have more affordable options if you’re willing to take a medical exam.

Learn more about the life insurance medical exam

Is no-exam life insurance worth it?

If you’re young and healthy enough to get approved for traditional life insurance, applying for a no-exam term policy is a no-brainer — you’ll be able to skip the medical test, get covered faster, and pay the most affordable premiums available to you.

And if you might not be eligible for traditional coverage due to health reasons, no-exam options like simplified issue or guaranteed issue are worth considering, since they can give you access to a small amount of coverage to pay for final expenses.

At Policygenius, our agents can help you compare quotes from different insurance companies and apply with the insurer that offers you the right coverage at a price that works for you.